Lifetime Gift And Estate Tax Exemption 2024. So, the current (2023) lifetime gift tax exclusion is. However, in 2024, this increases to $18,000 per person.

For those who have acquired enough wealth to surpass. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Visit The Estate And Gift Taxes Page For More Comprehensive Estate And Gift Tax Information.

The clock is ticking down on a temporary increase to federal lifetime gift and estate tax exemptions.

So, The Current (2023) Lifetime Gift Tax Exclusion Is.

Client to gift an amount equal to the federal estate tax exemption during their lifetime.

The 2017 Tax Cuts And Jobs Act (Tcja) Nearly Doubled The Lifetime Estate And Gift Tax Exemption From $5.6 Million To.

Images References :

Source: www.dglaw.com

Source: www.dglaw.com

2024 Lifetime Gift and Estate Tax Exemption Update Davis+Gilbert LLP, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. Also for 2024, the irs allows a person to give away up.

Source: mpmlaw.com

Source: mpmlaw.com

Federal Estate and Gift Tax Exemption set to Rise Substantially for, This increased exemption amount means that. Effective january 1, 2024, the lifetime exemption from the federal gift tax and estate tax will see a substantial increase.

Source: www.hinckleyallen.com

Source: www.hinckleyallen.com

Understanding 2024 Estate, Gift, and GenerationSkipping Transfer Tax, This increased exemption amount means that. These gifts will reduce the size of your estate and exposure to the estate of gst tax.

Source: opelon.com

Source: opelon.com

Discover The Latest Federal Estate Tax Exemption Increase For 2023, If you give more than $18,000 to someone in one year, the amount above the annual gift tax exclusion is taken from your lifetime gift and estate tax exemption. There's no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect.

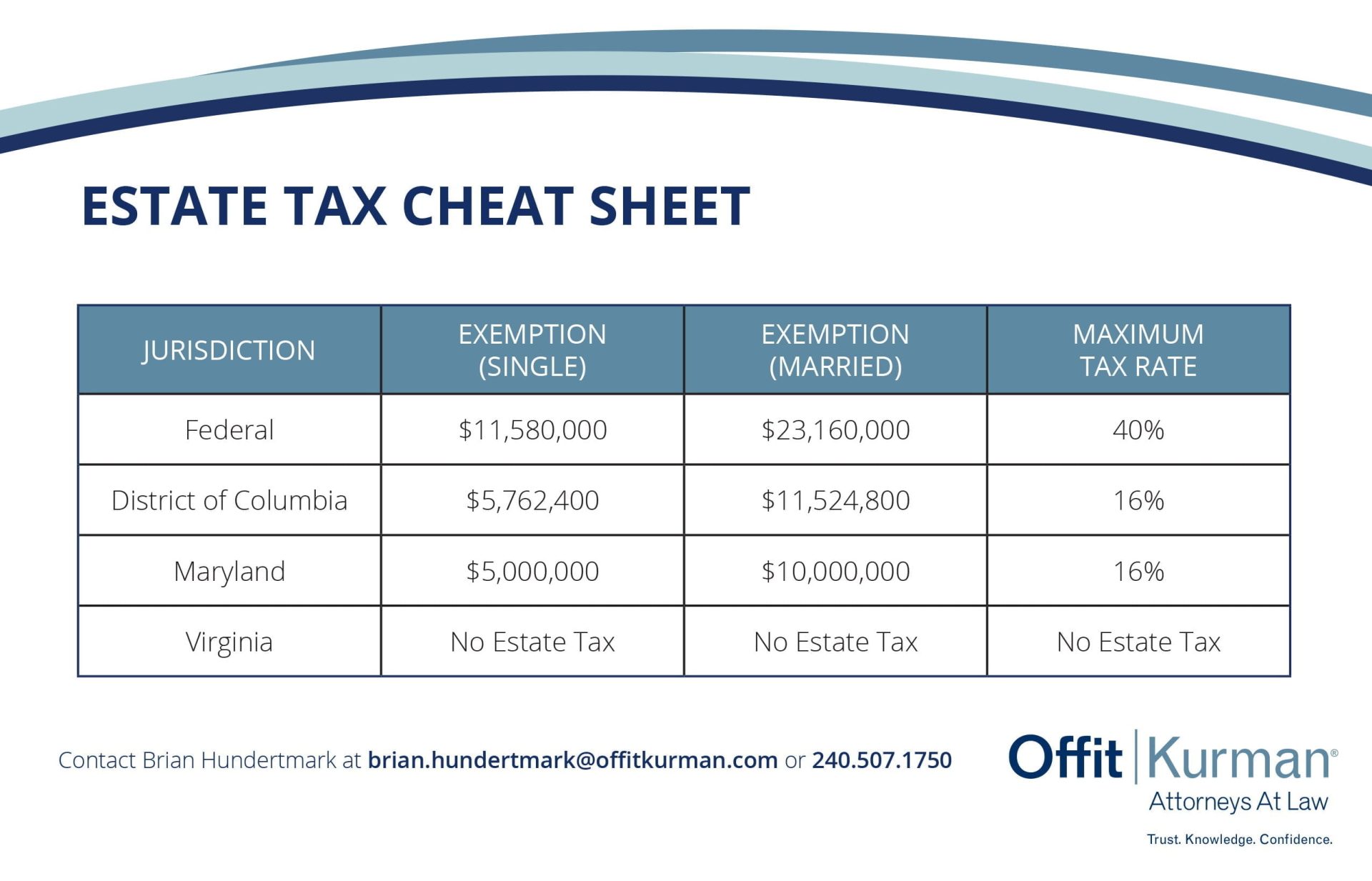

Source: offitkurman.com

Source: offitkurman.com

2020 Estate and Gift Taxes Offit Kurman, After 2025, the exemption will fall back to $5 million, adjusted for inflation, unless congress agrees to. The 2017 tax cuts and jobs act (tcja) nearly doubled the lifetime estate and gift tax exemption from $5.6 million to.

Source: rosaqlurleen.pages.dev

Source: rosaqlurleen.pages.dev

Lifetime Gifting Limit 2024 Hildy Joletta, Client to gift an amount equal to the federal estate tax exemption during their lifetime. Starting january 1, 2024, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

Source: www.varnumlaw.com

Source: www.varnumlaw.com

Increases to 2023 Estate and Gift Tax Exemptions Announced Varnum LLP, The lifetime estate and gift tax exemption for 2023 deaths is $12,920,000. The faqs on this page provide details on how tax reform affects estate and gift tax.

Source: www.evercorewealthandtrust.com

Source: www.evercorewealthandtrust.com

Gifting Time to Accelerate Plans? Evercore, If you give more than $18,000 to someone in one year, the amount above the annual gift tax exclusion is taken from your lifetime gift and estate tax exemption. Lifetime irs gift tax exemption if a gift exceeds the $18,000 limit for 2024, that does not automatically trigger the gift tax.

Source: actecfoundation.org

Source: actecfoundation.org

Gift Tax Exemption Lifetime Gift Tax Exemption, Starting january 1, 2024, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person. There's no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect.

Source: www.slideshare.net

Source: www.slideshare.net

The Lifetime Exemption to Gift and Estate Taxes, In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. There's no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect.

Each Spouse Can Take Advantage Of.

Any inheritance tax due on gifts is usually paid by the estate, unless you give away more than £325,000 in gifts in the 7 years before your death.

This Increased Exemption Amount Means That.

Here are the key numbers: